SpreadSheetBuddy

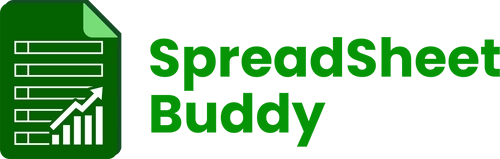

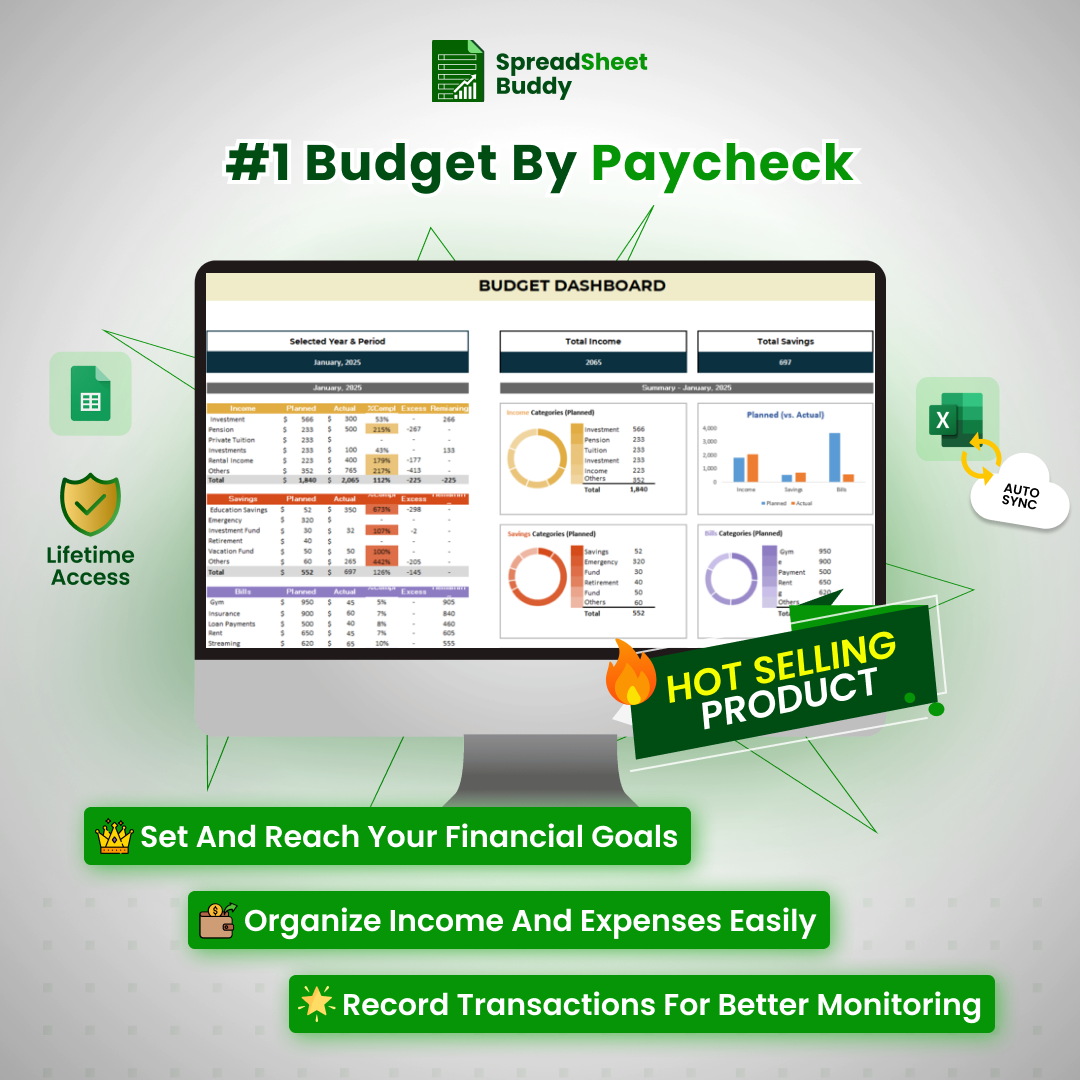

#1 Paycheck Budget Planner

#1 Paycheck Budget Planner

Couldn't load pickup availability

Fast Delivery Instant Download

Fast Delivery Instant Download

Free Update for Lifetime

Instructional Guide and Video

-

What's Included

-

Product Description

- Both Excel and Google sheets

- Instructional Guides

- Instant delivery to your email

- All devices compatibility

- Customizable and User-friendly templates

- Visual insights and Reports inside the templates

- Free Instructional Videos

The Paycheck Budget Planner and Habit Tracker bundle combines personal finance and productivity tools to help you create consistent habits and manage your income effectively.

Here’s What’s Inside This Bundle:

- Paycheck Budget Planner

- Habit Tracker

- Customizable Financial Goals

- Daily, Weekly, and Monthly Habit Views

This bundle offers an easy but effective method for staying organized and achieving your objectives, whether you're focused on developing new routines, improving your financial situation, or both.

Why Choose to Take Control of Your Finances with Ease

✅ Manage up to 40+ income streams and expense categories for detailed tracking.

✅ Seamlessly sync with weekly, bi-weekly, or monthly pay cycles.

✅ Break free from paycheck-to-paycheck living with effective planning.

✅ Simplify budgeting and gain financial clarity with ease.

✅ Minimize stress with an organized, transparent financial overview.

Caption

Master Your Monthly Finances

The Budget by Paycheck Tracker is the perfect tool for conveniently controlling income and expenses. To make sure every paycheck is paid for, divide your monthly finances into manageable portions. This tracker makes tracking your progress and reaching your financial goals simple. It is accessible on all devices and compatible with Google Sheets and Excel. It helps you allocate your income purposefully, whether for bills, savings, or discretionary spending.

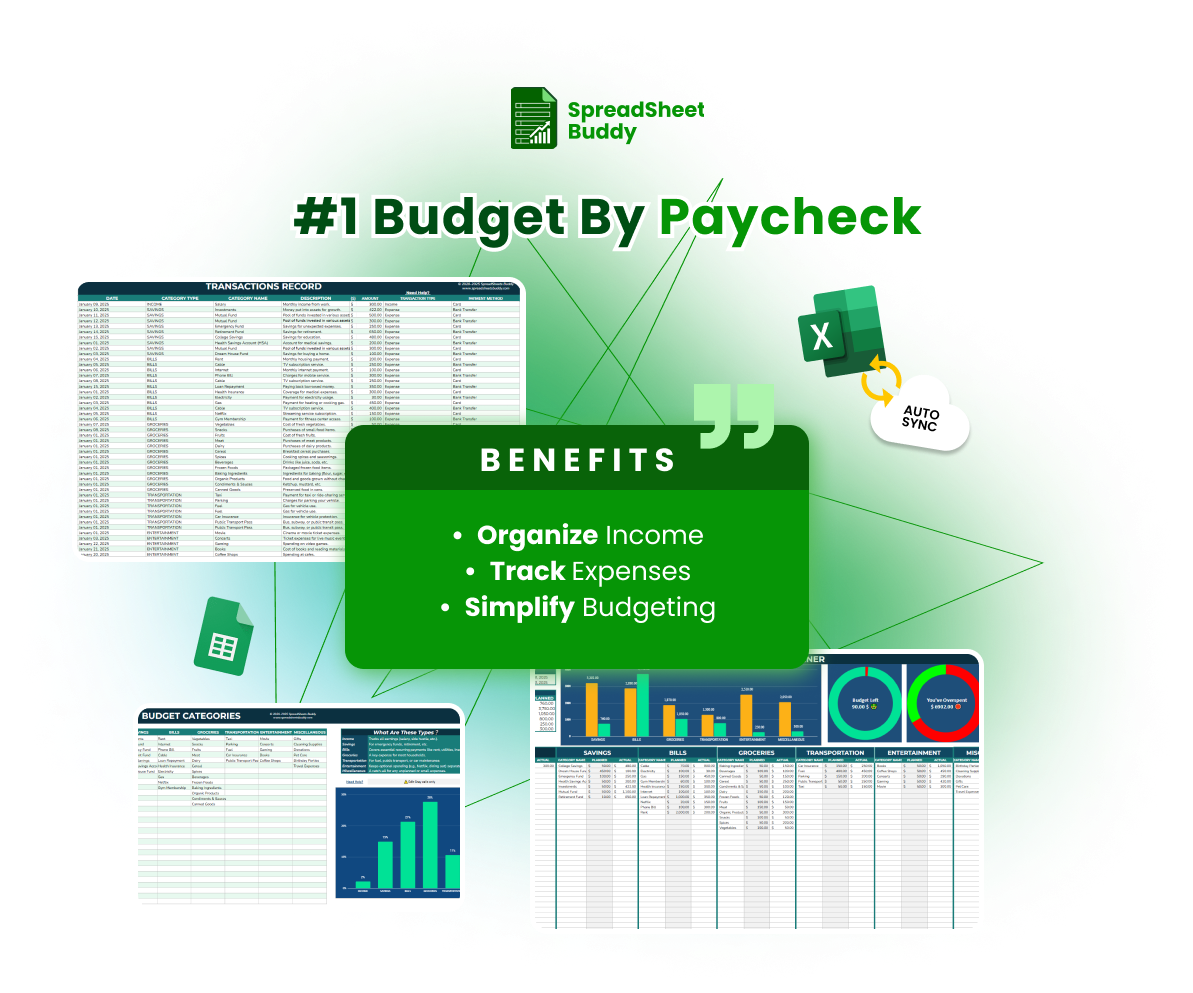

Fully Customizable

You can customize the Budget by Paycheck Tracker by Adjusting the colors, fonts, categories, and layouts to reflect your unique financial priorities and style. This tracker will fit your budgeting habits, ensuring it grows with you and remains the perfect tool for managing your paycheck-to-paycheck finances.

Budget By Paycheck

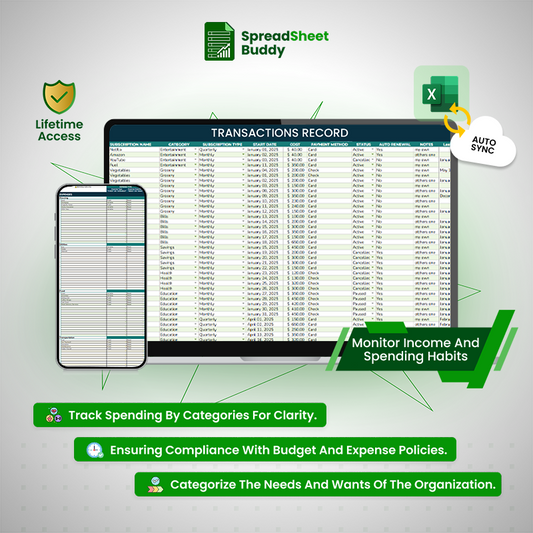

Adjust Template Parameters

Adjust the template's parameters according to your financial demands. Select your preferred currency type and symbol, round numbers for ease of use, and enter your nation for regional accuracy. These modifications guarantee the template is user-friendly and pertinent to your financial circumstances.

Define Budget Categories

Establish the budgetary categories that will serve as its framework. Add necessary categories such as Bills, Groceries, Transportation, Entertainment, Miscellaneous, Income, and Savings. Well-defined and well-structured categories facilitate effective money allocation and expenditure tracking.

Allocate Budget Amounts

Give each budget category a certain amount based on your expected earnings. Add the expected amounts for bills, groceries, transportation, entertainment, income, savings, and other costs. This stage assists you in developing a comprehensive budget that suits your financial objectives and pay cycle.

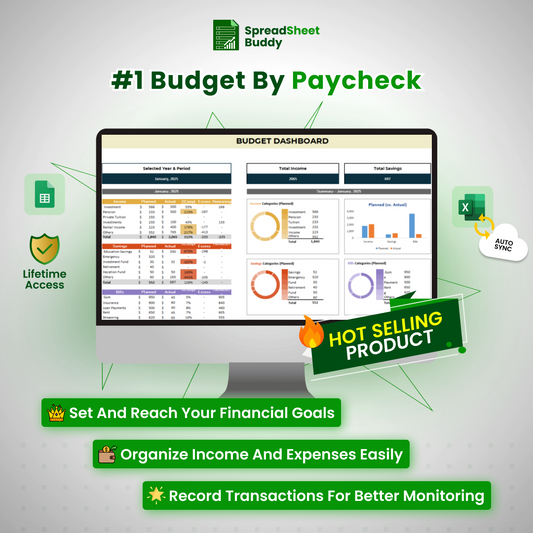

Track Financial Transactions

Use the template to keep a thorough record of all your financial activities. Enter information such as the date, kind of transaction (revenue or cost), amount, description, category, and payment method.

What Customers Say About Us?

SpreadSheetBuddy

All-in-One Financial Management Package

Fast Delivery Instant Download

Free Update for Lifetime

Instructional Guide and Video

Frequently Ask Questions

Does the template provide visual charts or graphs to track spending trends?

Yes, the template includes visual tools such as bar charts and pie charts to help you analyze your spending and income trends over time.

Can I import data from other financial tools or apps into the template?

While the template doesn’t have a direct import feature, you can copy and paste data from other sources into the appropriate sections, provided the format matches the template.

Is there an option to set up reminders for bill payments or savings goals?

The template itself doesn’t send reminders, but you can integrate it with calendar tools or set manual reminders in your device to stay on track.

What happens if I input incorrect data? Can it be corrected easily?

Absolutely! Simply locate the incorrect entry and update or delete it as needed. Any calculations tied to the data will update automatically.

Does the template support different tax systems for various countries?

The template provides customizable fields where you can manually input tax deductions specific to your region.

Featured collection

-

#1 Paycheck Budget Planner

Regular price From $12.99Regular priceUnit price per$84.00Sale price From $12.99Sale -

Smart AI Expense Tracker

Regular price From $29.00Regular priceUnit price per$49.00Sale price From $29.00Sale -

Emergency Fund Calculator

Regular price From $24.00Regular priceUnit price per$62.00Sale price From $24.00Sale